OPPORTUNITIES IN AFFORDABLE HOUSING DEVELOPMENT

BY KENNETH J. PUNCERELLI, CEO LAI DESIGN GROUP

As the economy continues to recover nearly 10 years after the mortgage meltdown, the costs of land, building materials and construction continue to rise. As Americans, many of us take for granted having clean running water or a warm dry place to sleep. There are segments of our population that are economically disadvantaged. The double edge sword of a free market society is that some are unable to attain the American dream without assistance. As the greatest country in the world, all Americans deserve opportunities for safe, clean, and affordable housing and this can be accomplished with Economic Development Incentives. Mayor’s in many cities across America including Denver, Houston, San Francisco, Chicago, New Orleans and other major cities have an Affordable Housing Initiative, which is a wakeup call for municipalities, developers and housing authorities to work together to deliver quality housing stock to our fellow Americans in need. Affordable Housing is often financed through Tax Credits (LIHTC - low income housing tax credits) and associated financing sources. These financial mechanisms are a tool that private developers as well as Public Housing Authorities can utilize to create Affordable Housing options. Often times these two groups form joint ventures to execute projects and often times they work independently.

The need for Affordable Housing is greater than we realize, below is an abbreviated list of the diverse populations that are underserved with Affordable Housing:

- Divorced single parent households

- Millennials with mounting student debt

- Lower income workforce

- Seniors

- Veterans

- Medically disabled

- Family's with single income

- Civil Servants

- School Teachers

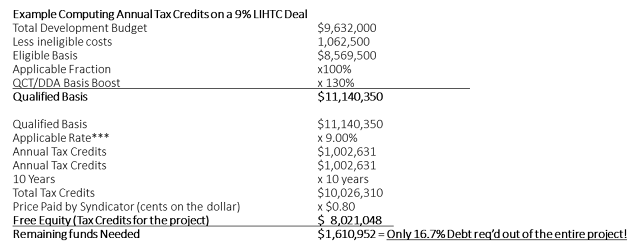

Types of tax credits include 9% and 4%. The 9% LIHTC typically provides approximately 70% of a project funds with the remaining 30% made of debt and/or other sources. While a 4% LIHTC provides 30% of project funding, the balance of funds is made up of other sources including debt. The 9% applications are very competitive and only the best projects are awarded funding annually. While the 4% applications are non-competitive, they do require other sources of capital to finance the project.

The challenge developers face with any LIHTC project is the rents charged to tenants are at a maximum of 60% of the AMI (area median income) and go down from there. Hence the reason the Tax Credits were invented, was to provide the available funding necessary that would otherwise require developer’s equity. Clearly the financial returns on owners’ equity for a Tax Credit deal is not enough to incent the private sector like a Market Rate deal. The credits come from large corporations who have a tax obligation and instead of the tax, they invest in Affordable Housing – Tax Credits, which is how funding becomes available and helps monetize these much needed projects.

WHAT DO TAX CREDITS FINANCE?

- New construction and rehab projects

- Acquisition in some cases

- Housing for families, special needs tenants, single room occupancy and the elderly

- Urban, rural and suburban locations

- Additional tax incentives for projects in high-cost or difficult-to-develop areas

REASONS FOR TAX CREDITS AS A FINANCING TOOL

- An instrument that can be monetized and used as a source of capital for a project.

- Instrument is sold to a syndicate or bank at 80-100% on the dollar.

- Creates opportunity for other funding sources to round out the capital stack.

- Grants,

- Low interest government Loans,

- CDBG (community development block grants),

- Other contributions from Municipality & Non-profits

- Typical debt and equity financing does not work economically for rents that are controlled based on a percentage of Area Median Income.

- Less financial risk to Sponsor due to non-recourse debt funding.

- Occupancy rates are typically high due to demand.

- Developer Fees up front range from 8-15%

HOW DO TAX CREDITS WORK?

- Rental units are leased to tenants earning no more than 60% of AMI

- Investors earn dollar-for-dollar credits against their federal tax liability

- Investors also get tax benefits from losses

- Generally, tax credits are received over the first 10 years of operation, these credits essentially cover your equity capital needed to fund the project. (see example calculation)

- Some tax credits are recaptured by the IRS if the project does not comply for 15 years, however the land use restriction remains for 15yrs. Which essentially requires periodic audits of tenant income to ensure no tenant is understating income levels and they remain in compliance of 60% AMI or less. Failure to comply has serious tax recapture penalties to the developer sponsor and partners, which is why your responsible to comply.

- A 9% LIHTC deal provides approximately 70% of a projects funding with the balance picked up by debt, soft funds (non-recourse) and/or owners’ equity.

- A 4% LIHTC deal provides approximately 30% of a projects equity with the balance picked up by other soft funds and/or owners’ equity.

Another source of funds when applying for LIHTC projects is the Basis Boost. The Basis Boost increases the eligible tax credit basis by 30% if project is in:

- a “qualified census tract” (QCT)

- a “difficult to develop area” (DDA) or

- a state designated difficult development area

- Does not apply to tax-exempt financed projects

The Basis Boost, additional funding source can help a developer overcome financial impediments to project finance i.e.; where construction costs maybe higher such as a market like San Francisco or NYC (DDA) or location where Affordable Housing opportunities are limited (QCT) and there is an underserved suburban market in good school districts vs poorer neighborhoods and thus additional funding incentivizes the developer to build a LIHTC project in the area.

Sourcing Capital for Affordable Housing projects 9% LIHTC & 4% tax exempt municipal bonds

- State Department of Housing for - funding

- Financial Institution or Insurance Company (syndicator) - equity

- City/County Affordable Housing Funds

- Public Agency Housing Funds

- HUD low interest loans

- Local Housing Authority

- Housing Choice Vouchers

- Community Development Block Grants (CDBG)

- Regional Employers (i.e.; resorts & factories)

- Financial Institution or Insurance Company – debt

FINANCIAL RISKS IN TAX CREDIT PROJECTS

- Upfront costs to put together the application for submittal to the State.

- Architecture

- Engineering Feasibility

- Market study

- Legal

- Tax Consultants

- Financial Consultants

These costs can be recovered if the applicant is successful in winning a 9% award. However, in a 4% application, the applicant can recover these costs as well. The downside on a 4% deal is that developers are required to piece together other funding in order to achieve the same 70%-plus funding described in a 9% deal. Both of these options require a strong Tax and Legal team.

Affordable housing shouldn’t be considered a negative land use or only for poor people. Low Income Housing Tax Credit (LIHTC) developments provide a much needed resource to our nation’s housing stock and a diverse population. The 9% LIHTC project while very competitive require quality design, amenities, and LEED compliance – (leadership in energy and environmental design). In order to receive Tax Credits, the applicants are required to develop quality projects. If either a 9% or 4% tax credit project is properly designed, the economic status of the residents is undetectable between “Affordable Housing” or “Market Rate Housing”, in fact often times they are blended because of various inclusionary housing provisions embedded with in local zoning codes throughout the nation. Additionally, blending Affordable and Market Rate housing diversifies the unit mix and tenant makeup which improves profitability while maintaining compliance with complex tax requirements. For these reasons, at least 10% of the units in an Affordable Housing development should be Market Rate to avoid compliance issues if tenants understate earnings for AMI compliance.

The Parties in a Tax Credit Syndication work together with the State Housing Finance Agency acting as the compliance entity that approves the eligibility of the Tax Credit application as well as ongoing review of a developments annual compliance with property management, tax reporting, adhering to tenant AMI rules and associated HUD rules.

DEVELOPMENT TEAM

- Developer

- General contractor

- Architect

- Attorney

- Accountant & Tax Consultant

- Property manager

- Consultants

LENDERS

- Construction lender

- Permanent lenders

- Lender attorneys

STATE HOUSING FINANCE AGENCY

- Syndicator

- Underwriter

- Fund manager

- Attorney

The same process applies in developing a 4% LIHTC deal. The remaining 40-50% of funds come from CDBG, Local Housing Authorities, and other sources (see list of sources) with debt making up the remaining 20-30% balance of funds need to finance the development.

The opportunities for developing Affordable Housing are numerous, not the least of which the ethical construct of conscious capitalism which states “one can do well financially by doing good”.

The opportunities for developing Affordable Housing are numerous, not the least of which the ethical construct of conscious capitalism which states “one can do well financially by doing good”.

OTHER MORE SPECIFIC POINTS INCLUDE:

- 8-15% developer fees up front at the time of development;

- After 15 yrs., the developer owns the property rights free and clear and can either refinance the debt or sell the property to others who invest in Affordable Housing Projects;

- Essentially free equity for the project via Tax Credit program 10yrs of tax credits paid up front to fund development;

- Requires developers to put down little to no equity;

- Developers receive Before Tax Cash Flows after expenses;

- Occasionally free land for the development of affordable housing is available from local sources;

- Developers receive a portion of property management fees;

- Low debt requirements after the tax credits & other soft funds;

- Non-recourse funding;

- The reimbursement for initial project expenses these include:

- Upfront costs to put together the application for submittal to the State.

- Architecture

- Engineering